puerto rico tax break

The zero tax rate covers both short-term and long-term capital gains. The government says Puerto Rico needs the money.

Do Puerto Rico Residents Owe Us Tax

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4.

. Private wealth clients hedge fund managers and cryptocurrency traders fleeing to Puerto Rico for its huge tax breaksand to escape President Joe Bidens proposed capital. Avoiding what he sees as unnecessarily high taxes in the Golden State in favor of Puerto Ricos considerable tax breaks. Critics say its not.

But after the crash of. 6 rows Puerto Rican non-residents are only taxed in Puerto Rico on their Puerto Rico-source income. The key to all this is that Puerto Rican income is exempt from US federal income tax.

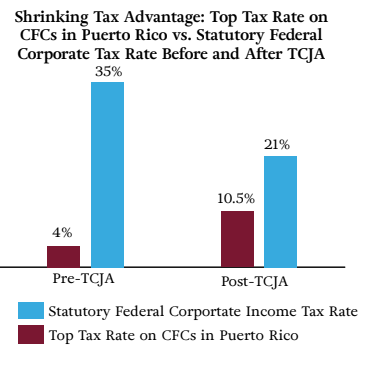

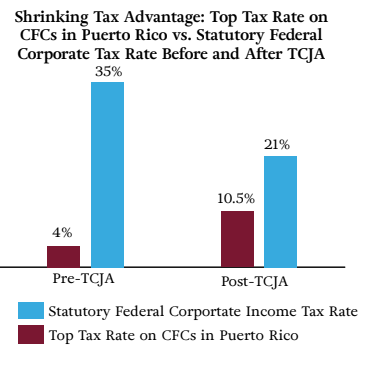

Many newcomers are also taking advantage of incentives designed for service-export companies that provide a 4 tax rate versus the islands standard rate of about 35. Foreign Earned Income Exclusion FEIE allows. Form 8898 requires the taxpayer to provide information.

You have to move. The Puerto Rico Sales and Use Tax SUT Spanish. A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks.

Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s. One of those tax breaks enacted in 1976 allowed US. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in.

In the table above you can see the income tax. Tax benefits for US expats in Puerto Rico. For years the wealthy have swarmed to Puerto Rico.

Paul is not alone. That didnt matter before because Puerto Rican taxes were just as high as US taxes. However this exemption from US.

Beyond the fact that Puerto Rico offers a year-round tropical backdrop with picturesque beaches the US. Legally avoiding the 37 federal rate and the 133 California or other state rate sounds. Super-Rich Headed to Puerto Rico With an Eye on Tax Breaks Jun 8 2021 Blog Because Puerto Rico offers substantial tax advantages a new trend has begun.

Sales and Use Tax. You add all the taxes together to get the total tax paid for 100000 to be 21135 which is an actual tax rate of 2114. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a.

Manufacturing companies to avoid corporate income taxes on profits made in US. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a. Impuesto a las Ventas y Uso IVU is the combined sales and use tax applied to most sales in Puerto Rico.

Act 22 is for individuals. US Americans living abroad can use two unique tax breaks to mitigate expats US tax burden. It confers a 100 tax holiday on passive income and capital gains for 20 years.

The taxpayer moving to Puerto Rico is required to file Form 8898 with the IRS and file Form 1040 for the year of move. If youre a bona fide resident of Puerto Rico youll be able to exclude income from Puerto Rican sources on your US. Territories including Puerto Rico.

Territory also has crypto-friendly policies including huge tax. HISTORY OF CRISIS.

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Low Taxes Island Life Make It Hot For Bitcoin Fans

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Why I Really Moved To Puerto Rico And You Should Too Doug Casey S International Man

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Puerto Rican Beach Parties Protest Public Beach Buy Up The Mary Sue

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

The Mckinsey Way To Save Puerto Rico

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Luring Buyers With Tax Breaks The New York Times